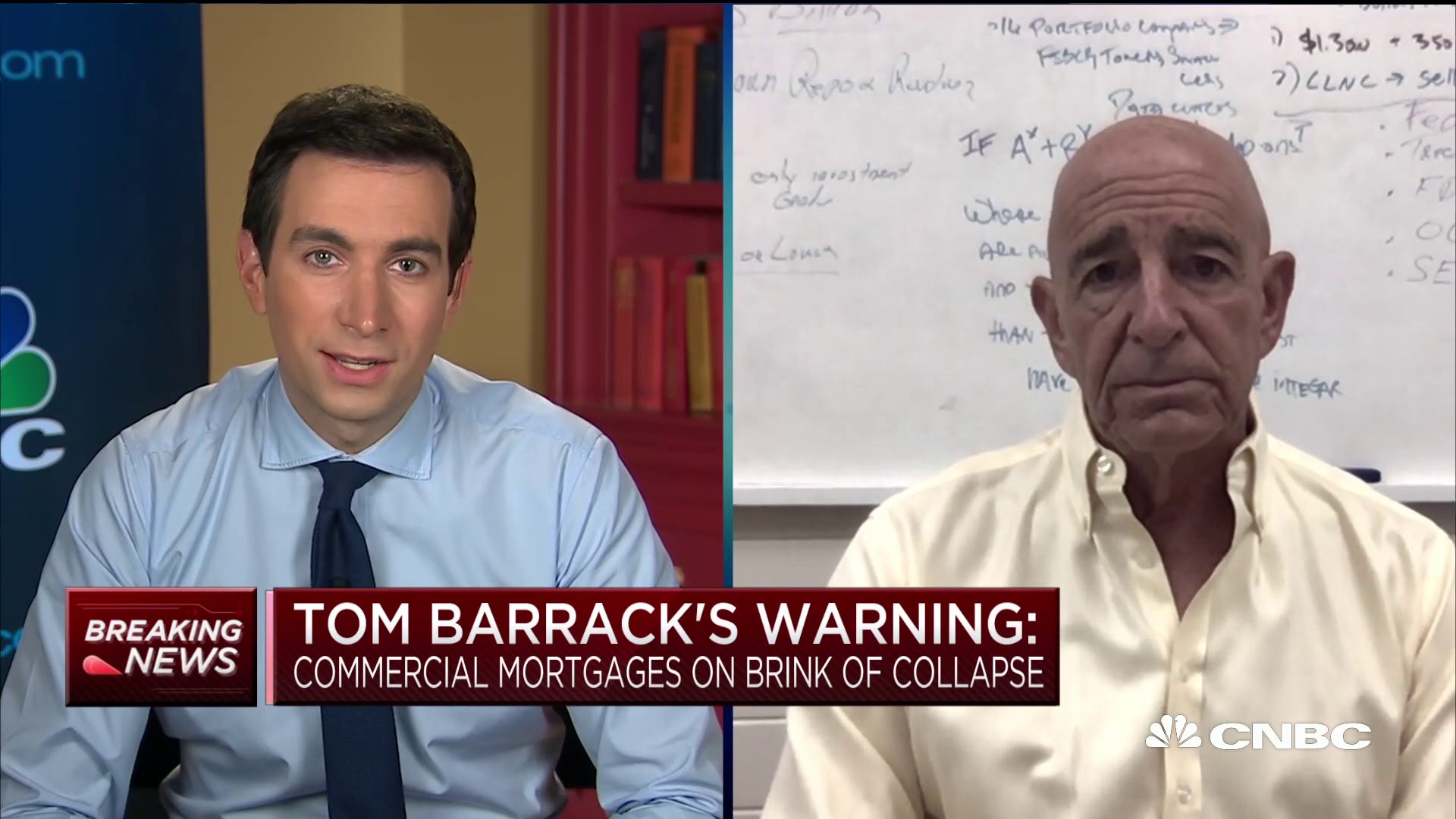

The crude oil crush has taken down power shares, however there could also be some survivors, in accordance with Less complicated Buying and selling director of choices Danielle Shay.

Crude briefly cracked beneath $20 on Monday taking it to ranges not seen since early 2002. Vitality shares have been dragged together with the sector tanking nearly 53% this yr and buying and selling close to ranges it final hit in early 2004.

Shay mentioned that atmosphere implies that solely the largest oil corporations will survive given the "disastrous state of affairs" crude now finds itself in. She mentioned power corporations "want oil to be $40 to $50 a barrel" for them to remain afloat.

"The one [names], on this state of affairs, which might be going to have the ability to survive are ones which have sufficient money available with a low debt-to-equity ratio," she mentioned Monday on CNBC's "Buying and selling Nation."

"These names are actually simply going to be Chevron, Exxon, after which the massive names which might be going to manage to pay for to get by this."

Mark Newton of Newton Advisors additionally believes the low is not in for...

Supply cnbc.com