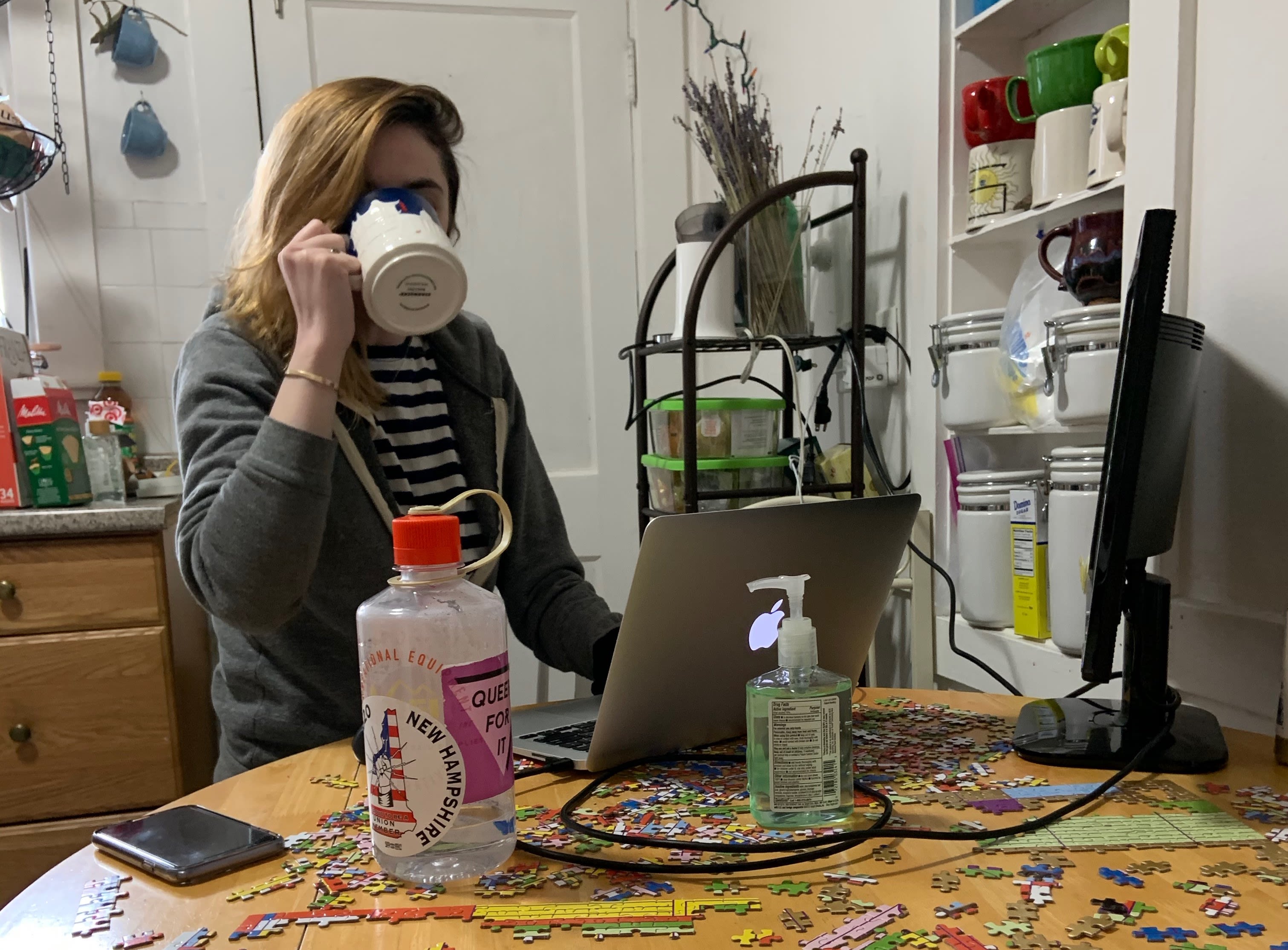

GaudiLab | iStock | Getty Photographs

Should you're working from house to cut back your publicity to coronavirus, do not count on to write down off the price in your 2020 taxes.

Staff who work out of their abode full-time – together with the legions of individuals just lately ordered to apply social distancing – have misplaced a key tax profit: the unreimbursed worker bills deduction.

The Tax Cuts and Jobs Act, which went into impact in 2018, put this and different "miscellaneous itemized deductions" on ice.

"We're bursting that bubble," stated April Walker, CPA and lead supervisor for tax apply and ethics on the American Institute of CPAs. "Should you're an worker, then it isn't an allowable deduction anymore."

Nevertheless, there is a silver lining for unbiased contractors and entrepreneurs who're working from house.

In that case, they will nonetheless deduct certified enterprise bills, together with a write-off for his or her house workplace.

Dwelling-office deduction

Impartial contractors and different self-employed people should meet two...

Supply cnbc.com